Biden’s Student Loan Forgiveness Claim Challenged By Congressional Records

On the day before President Biden announced that he is “forgiving” part or all of the student loans of nearly everyone who owes them, his administration released a legal memo declaring that he had the authority to do this under a 2003 law.

That claim is belied by Congressional records recently unearthed by Just Facts. These reveal that Congress voted to pass the law by a margin of more than 500 to 1 because it did not authorize any actions that would cost money.

In contrast, Biden’s decision to cancel student loans and alter their payment terms will cost from $605 billion to more than $1 trillion over the next 10 years.

That amounts to an average cost of roughly $4,700 to $7,700 for every household in the United States.

Before this, both Biden and Trump took similarly illegal actions to cancel interest on student loans, costing tens of billions of dollars.

The illegality of these actions is confirmed by the text of the law and Supreme Court decisions on similar cases dealing with presidential power grabs.

When the Covid-19 pandemic began in March 2020, the Trump administration announced that federal student loan borrowers won’t be charged any interest on their loans for “at least 60 days.”

The administration cited no legal authority for this decision, but within a week, Congress passed and President Trump signed a Covid relief law that suspended all federal student loan interest and payments for about six months through September 30, 2020.

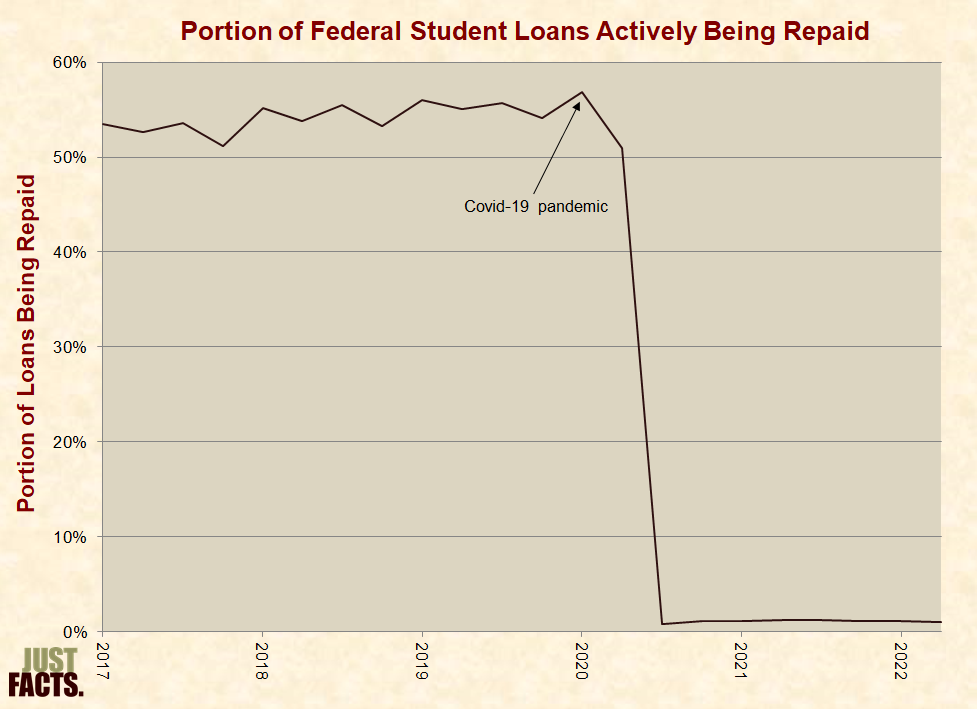

After that, Trump and Biden extended this policy for nearly two years even though Congress didn’t pass another law to extend the timeframe. Consequently, only 1% of all federal student loans are now actively being repaid:

The U.S. Government Accountability Office estimates that these interest cancellations have cost $102 billion.

In August 2022—after heavy pressure from the left-most faction of the Democratic Party and falling support from young voters, Biden announced that he was canceling up to $20,000 of student loan debt for people who have received Pell grants, the largest source of federal tuition handouts for low-income college students.

He was cancelling up to $10,000 of federal student loan debt for other borrowers who did not receive Pell grants.

These new laws were making these cancellations applicable to individuals currently earning up to $125,000 per year and couples earning up to $250,000, regardless of their future earnings capacity.

This would facilitate altering loan repayment terms “for both current and future borrowers” in ways that will reduce the average annual student loan payment “by more than $1,000.”

On the day before Biden announced those actions, his administration released a legal memo declaring that he had the authority to do all this under the Higher Education Relief Opportunities for Students Act of 2003, or “HEROES” Act.

The HEROES Act of 2003 was sponsored by Republican John Kline of Minnesota, who had served 25 years as a U.S. Marine.

When he introduced the bill in the House of Representatives, he declared that it would help “the troops who protect and defend the United States.”

At that time, many college students and recent grads who were members of the National Guard and Reserves were being deployed to carry out Operation Iraqi Freedom and anti-terror operations in response to the slaughter of 2,977 people on 9/11.

Stating that the bill was “simple in its purpose” and “specific in its intent,” Kline explained that it will “assist students who are being called up to active duty or active service” and those who are impacted by “a war, military contingency operation or a national emergency.”

He also emphasized that the bill would do this “without affecting the integrity” of student loan programs.

Demonstrating just how simple and specific the bill was, the official legislative record shows that the House of Representatives passed it by a vote of 421–1 with only “forty minutes of debate.”

The Senate then passed it “without amendment by unanimous consent.” If all 100 senators were present, this is a margin of 521 to 1. The only legislator to vote against it in all of Congress was George Miller, a Democrat from California.

Produced in association with JustFacts

Edited by Alberto Arellano and Newsdesk Manager

“What’s the latest with Florida Man?”

Get news, handpicked just for you, in your box.